Sweden is making bold moves in its energy strategy: combining major investments in nuclear power with a historic reversal on uranium mining policy. These twin shifts mark a critical inflection point for the country’s push toward climate resilience and energy security.

Small Modular Reactors: A New Era

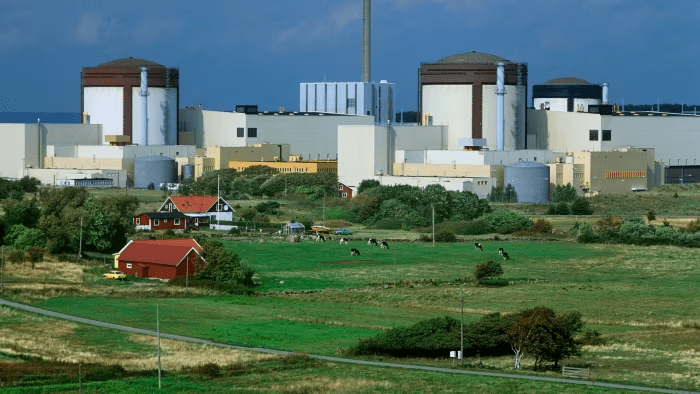

On 10 November 2025, a coalition of major Swedish industrial firms announced a SEK 400 million (~US $42.5 million) investment into the company Videberg Kraft, whose mission is to build one or more small modular reactors (SMRs) at the existing Vattenfall AB-run site at Ringhals in southwest Sweden.

The group of 17 companies includes industrial heavyweights such as Volvo Group, SKB AB and Volvo Cars. The plan is for these firms to take a 20 % equity stake in Videberg Kraft.

According to Vattenfall’s CEO Anna Borg, Sweden is now closer to building new nuclear reactors than it has been in the past four decades.

The ambitious target: 3 to 5 SMRs producing around 1,500 MW of power, with a broader plan of up to 12 new reactors by 2045 at an estimated cost of SEK 400 billion.

This move signals a strategic departure from the previous decades of retrenchment in Sweden’s nuclear-power sector. The emphasis on modular reactors reflects a focus on faster deployment, safer operation and better alignment with Sweden’s renewable ambitions and grid stability needs.

Uranium Mining Ban Lifted

Parallel to the reactor investment, Sweden is also reversing a seven-year moratorium on uranium mining. In early November 2025, the Swedish parliament reclassified uranium as a “concession mineral” under the Minerals Act, thereby opening the path for normal mining permit processes to kick in as of 1 January 2026.

This pivot comes amid the government’s drive to bolster energy security, reduce supply-chain vulnerabilities in nuclear fuel, and tap into domestic reserves that industry estimates may account for some 27 % of Europe’s known uranium resources.

Industry players moved immediately: Aura Energy Ltd., which holds the Häggån deposit, saw its shares surge by 11 % on the news.

The move underscores how Sweden is positioning itself as a key node in Europe’s nuclear-fuel supply chain.

Why it matters

The significance of these developments extends well beyond Sweden’s shores:

- Energy security and independence: With global supply-chain pressures, especially for nuclear fuels, Sweden’s domestic push gives it more control over critical inputs.

- Climate transition: While renewables like wind and solar remain important, nuclear offers reliable baseload power — essential for net-zero targets and grid stability when renewables fluctuate.

- Industrial strategy: Swedish heavy industry (automotive, chemicals, manufacturing) stands to benefit from reliable, low-carbon power — a factor in Swedish firms’ competitiveness globally.

- Geopolitical relevance: As Europe seeks to reduce dependence on external uranium suppliers (notably Russia and Kazakhstan), Sweden’s policy shift helps diversify supply for the whole bloc.

- Technological leadership: By adopting SMRs and enabling domestic uranium production, Sweden aims to advance its role in next-generation nuclear tech and mining.

The trade-offs and risks

Ambitious as the strategy is, it is not without challenges:

- High capital costs and long lead-times: Nuclear projects remain expensive and years from operation; SMRs, while more modular, are still scaling.

- Regulatory, environmental and public-acceptance hurdles: Uranium mining raises concerns about radiation, tailings, indigenous rights (Sámi populations) and legacy environmental impact. Sweden emphasises rigorous regulation and stakeholder consultation.

- Competition and global market pressures: Uranium mining is already dominated by established players. Sweden’s entry may affect production economics and time-to-market.

- Grid integration and energy mix: Integrating new nuclear capacity with renewables demands sophisticated planning and investment in grid infrastructure and storage.

- Policy coherence: The shift toward nuclear must align with Sweden’s broader climate, resource-management and social-licence objectives to avoid reputational risk.

What to expect & key milestones

Looking ahead, Sweden will be watched closely on several fronts:

- Selection of SMR supplier: By 2026 the decision on which firm will supply the SMRs (candidates include Britain’s Rolls-Royce SMR and the U.S.-based GE Vernova) is expected.

- Permit applications and regulatory approvals: For both the reactor site and the uranium mining concessions. This will test Sweden’s environmental-framework capacity.

- Initial production forecast: While deployment is years away, companies will announce timelines that give shape to the industry.

- Financial commitments and commercial models: The cost burden may spread across government and industry; Sweden’s strategy for cost-sharing and risk allocation will be closely scrutinised.

- Community and stakeholder engagement: Especially in mining areas, Sweden’s ability to manage social and environmental issues will be a major factor in public acceptance.

Conclusion

Sweden’s twin moves — committing to SMRs and opening the door to uranium mining — mark a bold shift in Scandinavian energy strategy. The country is clearly signalling that it intends to be a leader in the next phase of nuclear energy and a domestic supplier of critical fuel resources for Europe. Whether the plan proceeds smoothly remains to be seen, but what is undeniable is that Sweden is re-setting its energy trajectory.

Leave a comment